Latest

News

Network International expects organic growth as rate of card transactions grows in Middle East

Published On : Jun / 27 / 2018

Network International, the leading payment solutions provider in the Middle East and Africa (MEA), discussed plans for organic growth at its 11th Partner Meet held recently in Prague.

The company addressed its merchant and financial institution partners on opportunities in the regional payments industry, confirming a bullish projection on its organic and regional expansion plans. This, against the backdrop of card volume and non-cash payment transactions growing year on year since 2011 at an annual rate of 10%, from 10 million to nearly 16 million in 2016.

Speaking at the event, Samer Soliman, Managing Director – Middle East, Network International, commented: “As the US $5 trillion global payment industry experiences disruptive changes, we anticipate exponential growth in the MEA region. A confluence of factors including a majority tech-savvy demographic, proactive government policies, the coming-of-age of mobile POS in a region with high mobile penetration rates, and the emergence of a bilateral payments environment where anyone can be a merchant, and every device can accept payments, are all edging us towards an increasingly cashless society.”

Elaborating on the company’s optimistic outlook, Soliman pointed out that the Middle East land Africa collectively account for the world’s fastest-growing payment cards region. The MEA region already leads some markets in adopting technologies such as contactless payments and the emphasis on financial inclusion is set to play a key role in bringing forecasts of a nearly one billion card uptake in the MEA bloc by 2021 to fruition. Network International will be playing a key role as a payment solutions provider at Expo 2020 Dubai, where the company’s majority shareholder Emirates NBD Group will be a Premier Partner.

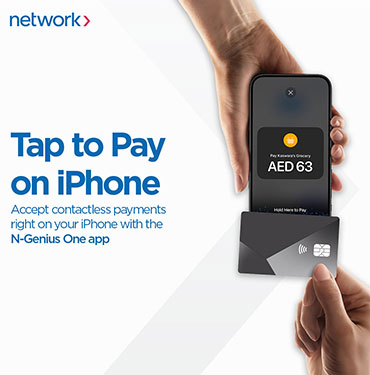

Network International’s 11th Partner Meet capped a successful year as the company rolled out a suite of products and services for the MEA market, including N-Advisors, an analytics and consulting product offering to service its more than 200 banking clients across the 55 countries in which it operates. Network international also recently debuted N-Genius™, an Android-based payment platform with the capability to manage and accept payments, either at the cash register or on the go. The UAE’s largest acquirer has also taken the lead in creating a national card spend index tracking changes in consumer card spending in the UAE on a quarterly basis.

Speakers at Network International’s 11th Partner Meet included Dr. Christian Scherrer, Principal Data Science Consultant, Blue Yonder; Jake Sullivan, former National Security Advisor to the Vice President of the United States; Dr. Kjell Nordstrom, renowned economist and best-selling author; Omar Al Busaidy, Entrepreneur, Author and Futurist; Ramesh Cidambi, Chief Operating Officer, Dubai Duty Free; and Suvo Sarkar, Senior EVP and Group Head – Retail Banking and Wealth Management, Emirates NBD.