Latest

News

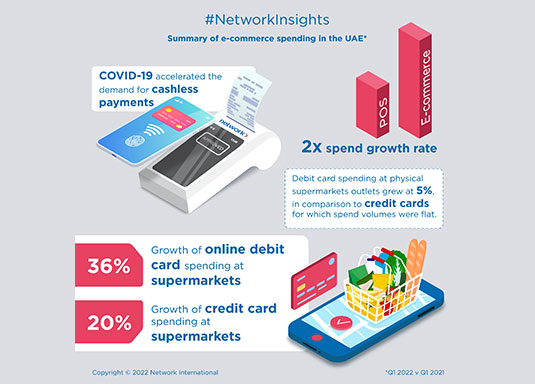

E-commerce spend grew 2x times the growth rate of POS in Q1 2022 v Q1 2021

Published On : Jun / 09 / 2022

- Growth in spend volumes fuelled by increase in online payments in government, supermarkets, convenience stores and restaurants sector

- Rise in number of cards transacting online up by 32% indicating permanent shift in consumer behaviour and higher dependence on digital commerce

- Growth driven by cards with low to mid value monthly spends

- Debit cards transacting during the quarter grew at 1.5x times the number of credit cards

- Supermarkets witnessed a nearly double digit jump in average card spends for e-commerce while POS spending stayed the same

E-commerce spending in the UAE grew at double the rate of point of sale (POS) transactions in the first quarter of 2022 compared to the same quarter a year earlier, according to Network International, the leading enabler of digital commerce across the Middle East and Africa (MEA).

The rise in online spending – which includes both debit card and credit card transactions – was led by digital payments in the government sector followed by restaurants, supermarkets and convenience stores, which accounted for more than 45% of total spend volumes.

As the UAE's largest merchant acquirer and the largest payment solutions company in the MEA region, Network International's platforms deliver comprehensive insights into all the payment transactions within an enterprise, while offering merchants the agility to build peerless customer experiences and increase acceptance capabilities.

With the accelerating demand for cashless payments in the ongoing COVID-19 pandemic, overall card spends in Q1 2022 saw a double digit increase over the same quarter in 2021. The total number of cards transacting online also climbed by 32%, indicating a permanent shift in consumer behaviour post-pandemic and higher dependence on digital commerce.

This growth was driven by low value and mid-value spending cards signalling a shift in payments behaviour among segments who previously primarily transacted in cash or where card spending was moderate. Further, the number of debit cards transacting during the quarter grew at 1.5x times the number of credit cards. Additionally, spending by low value and mid value spending credit cardholders increased at a higher rate than spending by the highest spending consumers.

Online debit card spending at supermarkets also grew by 36% in comparison to online credit card spends that grew by 20%. Network previously reported that UAE residents spent more when they did their supermarket shopping online after the COVID-19 lockdown restrictions, as compared to when they made their purchases at an outlet. [1] Continuing this trend from 2020, supermarkets witnessed a nearly double digit jump in average card spends for e-commerce while POS spending stayed the same. Meanwhile, debit card spending at physical supermarkets outlets grew at 5%, in comparison to credit cards for which spend volumes were flat.

Ian Jiggens, Group Head, Advisory and Information Services, Network International, said: “As e-commerce sales continue to rise, it is evident that the growth in spending is coming not just from buyers shifting from physical outlets to online shopping, but rather from buyers shifting more of their spending from cash to digital. Digital payments are at the forefront of some of the most interesting applications of new technologies, and merchants need to prioritise both the tools and the use of data to help them continue adapting to changing market dynamics. As the UAE’s largest merchant acquirer and the leading enabler of digital commerce across the MEA, Network plays a critical role in helping businesses transition to e-commerce to win in the new digital landscape.”